Learn How Citibank Personal Loans Work and Whether They’re Worth It

Anúncios

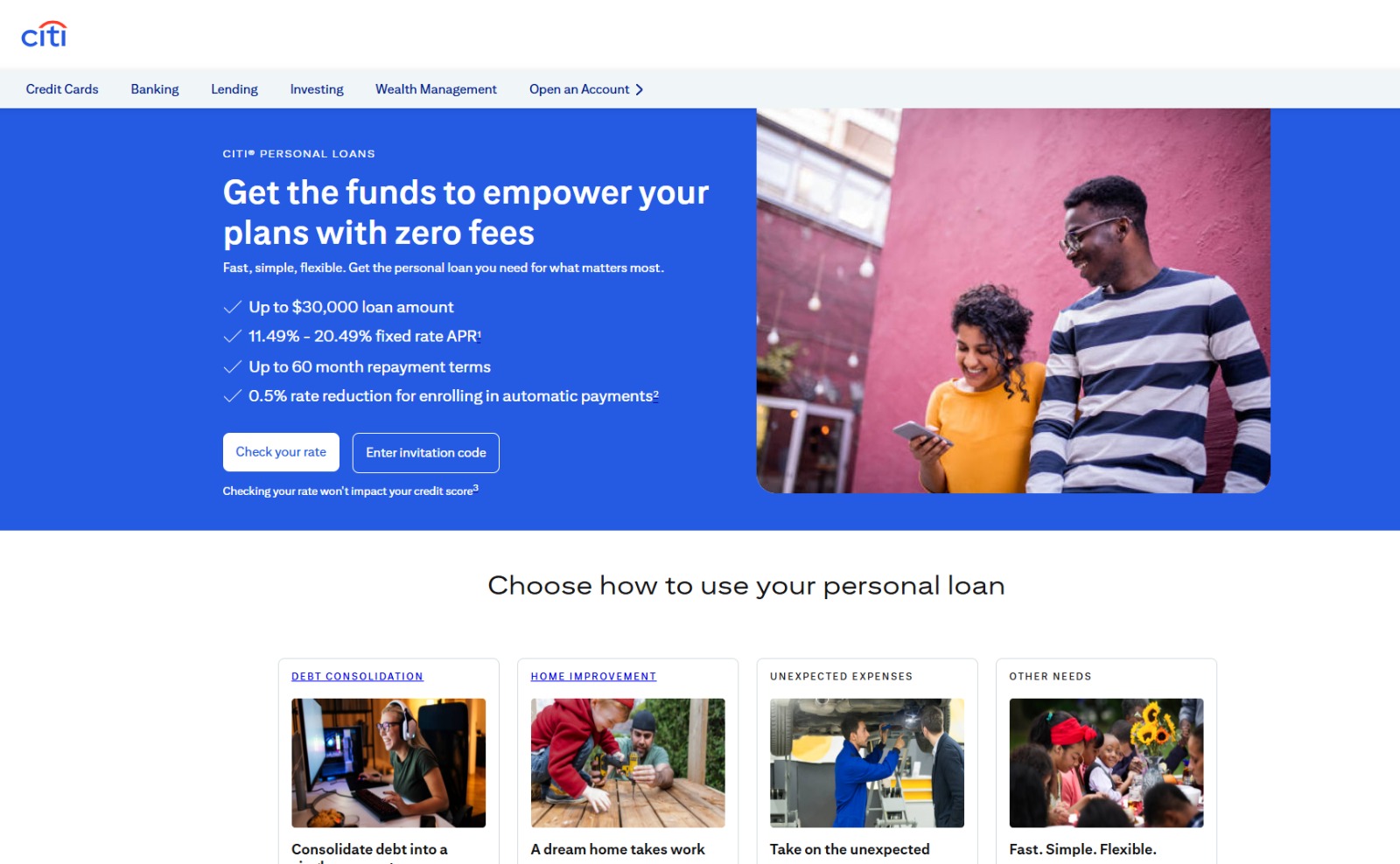

Citibank Personal Loans offer a secure and practical option for those in need of an unsecured loan.

Backed by one of the largest financial institutions in the world, these loans provide flexibility, competitive interest rates, and an easy application process.

Anúncios

In this article, we’ll break down everything you need to know about Citibank Personal Loans, including interest rates, terms, eligibility requirements, benefits, drawbacks, and a step-by-step guide to applying.

Read on to determine if this is the right financial solution for you and learn how to start your application today.

Anúncios

Key Details About Citibank Personal Loans

Before deciding if a Citibank Personal Loan is right for you, it’s important to understand the essential terms:

- APR (Annual Percentage Rate): Interest rates range from 11.49% to 20.49%, depending on your credit score and other factors.

- Loan Term: Repayment periods vary from 12 to 60 months, allowing borrowers to select a timeframe that fits their financial situation.

- Loan Amount: Borrowers can request amounts ranging from $2,000 to $30,000, making it suitable for various needs.

These terms provide transparency and flexibility, helping borrowers select the best loan option for their circumstances.

Who Is Eligible for a Citibank Personal Loan?

To qualify for a Citibank Personal Loan, applicants must meet specific requirements, including:

- Having a Citibank account for at least 12 months before applying.

- Maintaining a good credit score, which directly impacts approval and interest rates.

- Providing proof of income and other financial documents for the credit evaluation process.

- Being at least 18 years old (or 21 years old if residing in Puerto Rico).

These requirements ensure that loans are granted to individuals who can manage repayment responsibly, fostering a positive borrowing experience.

Why Consider a Citibank Personal Loan?

Citibank Personal Loans stand out due to their convenience, transparency, and borrower-friendly policies. Here are some of their key advantages:

Simple and Efficient Application Process

Applicants can apply online or by phone, with clear instructions on how to submit documents and track their application status.

In other words, it is a process that makes it much easier for those who want money urgently.

No Hidden Fees

Citibank Personal Loans come with no origination fees or prepayment penalties, ensuring there are no unexpected costs during repayment.

Therefore, it is a positive point for those who need money and are not in an ideal moment to deal with a series of fees.

Interest Rate Discounts for Automatic Payments

Borrowers who enroll in automatic payments may qualify for discounted interest rates, lowering the overall loan cost while ensuring timely payments.

These benefits make Citibank Personal Loans a strong choice for those seeking a straightforward, cost-effective lending solution.

Potential Drawbacks of Citibank Personal Loans

Despite their advantages, Citibank Personal Loans come with certain limitations that may not suit every borrower.

Limited Maximum Loan Amount

The $30,000 cap may not be sufficient for those requiring larger funds for major home renovations, large investments, or major life events.

Usage Restrictions

Citibank Personal Loans cannot be used for:

- Post-secondary education expenses, such as tuition or professional course fees.

- Business purposes, including working capital or financing commercial ventures.

Borrowers looking to cover these costs may need to explore alternative lending options.

Restrictions on Debt Consolidation

While debt consolidation is a popular use for Citibank Personal Loans, certain credit cards may not be eligible for consolidation under the bank’s terms.

It’s crucial to verify eligibility with Citibank before applying to avoid any surprises.

Step-by-Step Guide to Applying for a Citibank Personal Loan

Applying for a Citibank Personal Loan is quick and straightforward, with two main options:

- Online: Visit the official Citibank website, fill out the application form, and submit the necessary documents. You can also use the prequalification tool to check eligibility without affecting your credit score.

- By Phone: Call Citibank at 1-833-382-0004 (Extension 1106) for step-by-step guidance from a representative.

The process is designed for convenience, with customer support available to assist applicants throughout their loan journey.

Citibank Personal Loans provide a secure and flexible borrowing option with clear terms and a hassle-free application process.

However, it’s essential to consider the limitations, such as loan amount restrictions and usage limitations, before making a final decision.

Contact: For questions, you can reach Citi support at 1-833-382-0004.

If you’re ready to explore your loan options, click the button below for more details and to start your application today.

This content was produced in January 2025, and the information may change. Therefore, we recommend visiting the official Citibank website to get the most up-to-date information and confidently start your application.