Gotrade Review: The Best Stock Investment App for Beginners?

Anúncios

Gotrade Review

Gotrade is one of the best stock investment apps for beginners. We strongly recommend this app to everyone who wants to start investing in stocks.

Application Category: Stock Investment

Anúncios

4.5

Pros

- Easy to use and beginner friendly.

- You can buy US stocks starting from $1.

- Instant withdrawal after 3 days of waiting time.

Cons

- You still have to learn about the fundamentals of stock trading to know when to buy and sell your stocks.

- You might need to invest at least $30 if you decide to invest in public company stock. Otherwise, you might lose your initial investment due to the fluctuating rate.

In this Gotrade review, let’s find out if this is the best stock investment app for beginners.

If this is your first time hearing about a stock investment app, you don’t have to worry about it. It’s our first, too. In fact, we didn’t know anything about investing at all.

Anúncios

Nowadays, people are more interested in investment than a couple of years ago. There are a lot of apps about investment out there. So, you might get confused about which apps to choose. That’s why we recommend something off the grid called Gotrade

If you have no experience with stock investment, Gotrade might be one of the best apps to use as a beginner. It has a friendly user interface and doesn’t take long to learn.

Before diving into the review, you might want to learn a thing or two about stock investment.

What is a Stock Investment?

We assume that many people don’t know about stock investments like us. So, we’ll try to explain it to you in plain English.

Stock investment is about buying shares of ownership from public companies. By owning a small percentage of the company’s stocks, you’re investing in that company.

You might already know big public companies like Apple, Amazon, Google, and Tesla. However, did you know you can buy those companies’ shares?

In short, stocks are pieces of ownership of a company. Think of a company as a large pizza. You cut that pizza into 100 tiny pieces. Each piece represents 1% of the company that anyone can buy. If you buy 10 slices, you own 10% of that company. That’s how a stock investment works.

Now, someday in the future, you’re hoping the company performs well and grows over time. At that point, your stocks become valuable. Other investors might want to buy from you for more than your actual investment. So, you can earn a profit if you decide to sell them. In other words, you can make money in the long run by investing in stocks.

What is Gotrade?

Gotrade is a mobile brokerage that allows people to invest in fractions of US shares. You might be asking, what does fraction mean? Here’s how it works. A fraction means you’re buying less than one share.

Let’s say you want to buy Apple’s stocks. However, you find out they are trading for $100/share, and you can’t afford it. Now, Gotrade allows you to buy a fraction of 1/100th of Apple’s share with only $1.

How is this possible? Gotrade works with US regulated stockbroker who fractionalizes the shares. In other words, you can own a small unit from many famous companies, like Apple, Amazon, and Google, by purchasing a fraction of their company shares.

Buying a fractionalized share is helpful for people who want to invest in stocks starting from a low price of $1. That’s why we think it’s one of the best alternatives for beginners like us.

Why Should You Use Gotrade?

There are seven reasons why we recommend Gotrade as the best stock investment app for beginners.

- Product-wise, Gotrade is offering real stocks, not CFDs. So, when you invest in company stock, your name is listed as the owner. We’ll explain this later in the FAQ section.

- Gotrade offers you fractional share trading. You can buy any stock starting from $1.

- You can deposit as little as $10 to start.

- Gotrade is also commission-free. There are no buy or sell fees.

- There are no admin, custody, inactivity, or dividend fees.

- Gotrade also supports deposits in over 70 countries with low conversion rates.

- Above all, the Securities Investor Protection Corporation (SIPC) protects your account for up to $500,000.

How to Open a Gotrade Account?

Opening an account at Gotrade is easy. You only need a government-issued photo ID, a smartphone, and about 5 minutes to do it. The verification process doesn’t take long. We did ours in less than 24 hours.

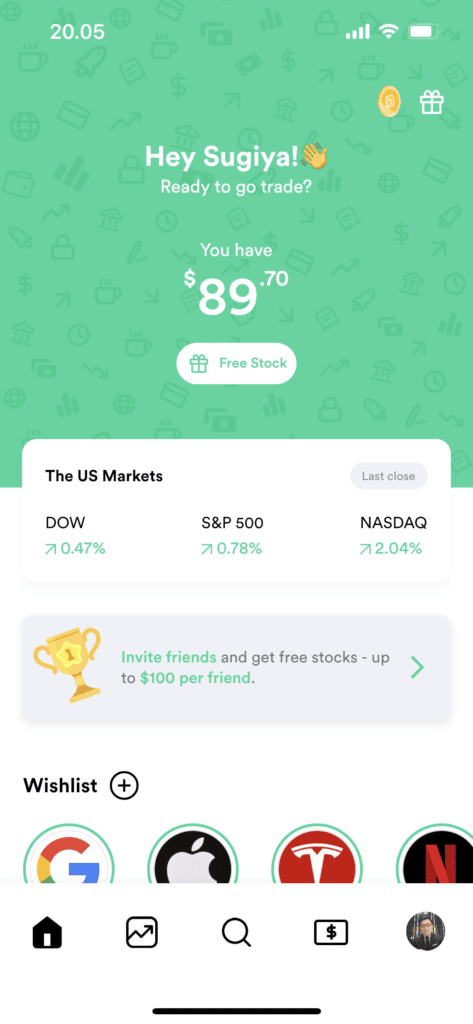

Once you have opened an account, you need to deposit a small amount of money to your Gotrade account. Depending on your country, you could deposit as little as $10 for your first deposit.

Is Gotrade Safe?

You might be thinking, where exactly your funds and stocks will be held? Is it safe to put your money on Gotrade?

Alpaca Securities LLC will hold all your funds and stocks. It’s their appointed clearing broker and custodian.

Alpaca is a member of the Financial Industry Regulatory Authority, Inc., or FINRA. You can check their background on FINRA’s BrokerCheck.

Alpaca is also a member of SIPC where your account is protected for up to $500,000. You can also visit www.sipc.org for more information. In short, your fund is in the safe hand.

How to Buy or Sell a Stock on Gotrade?

Gotrade’s user interface is well-designed and easy to use. You can buy or sell a stock in 6 simple steps.

Step 1

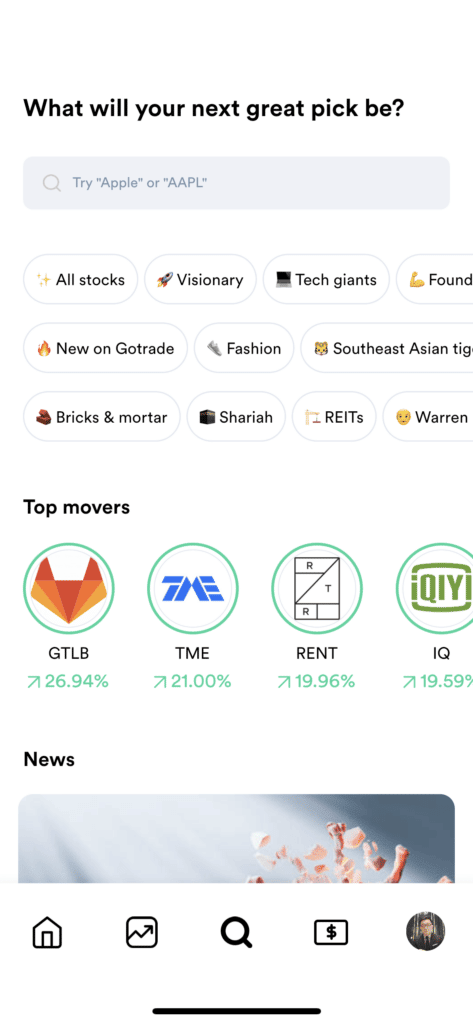

Navigate to the Discover screen (the magnifying glass icon) and search for the stock you want to trade. You can search by name to make it easier.

Step 2

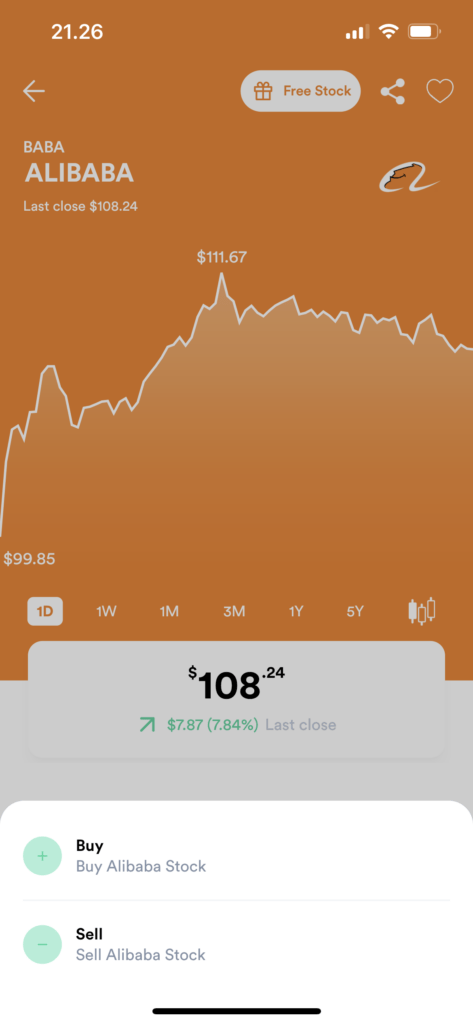

Click on the search result to find your preferred company to invest in.

Step 3

Click on the Trade button. If you already own the stock, you’ll see an option whether you want to buy more or sell it. Otherwise, Gotrade will process it as a buy.

Step 4

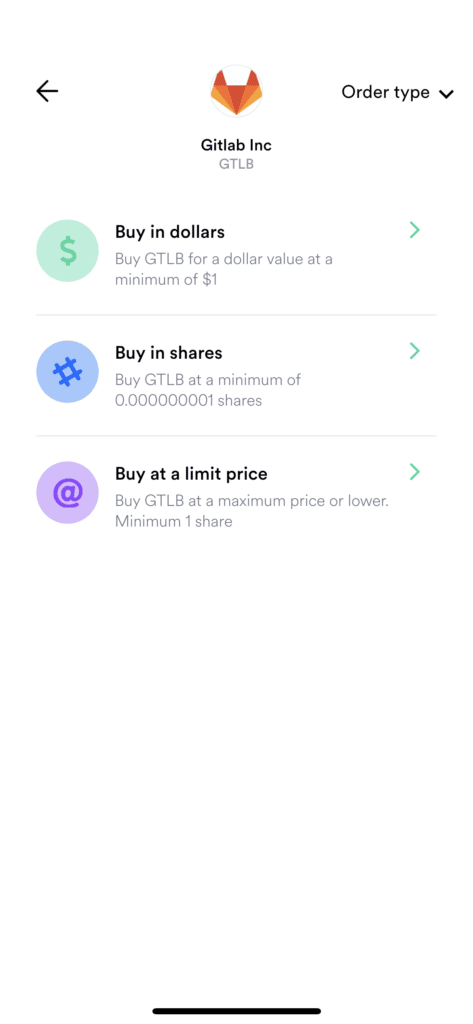

Set your order type. You can choose three different order types. Buy in dollars, shares, or at a limited price. We’ll explore more about this in the FAQ section.

Step 5

Input your order and tap the Preview Buy button.

Step 6

Review your order and then swipe up to complete your transaction.

Even though we have never bought stocks, these steps are easy to follow for beginners like us.

How to Track Your Stock Portfolios?

You can see all your stocks in the Portfolio section on your home and portfolio screen. Moreover, Gotrade will provide you with access to every transaction, such as:

- Financial Transactions. You can check every deposit, trade, and withdrawal you’ve made via Gotrade.

- Trade Confirmations. You’ll get a daily recap of all trades executed on your account.

- Monthly Statements. You’ll get a monthly snapshot of your entire account.

- Tax Forms. You’ll also get an annual form to help you fulfill your taxes.

Gotrade Fees & Charges

Gotrade does not charge you commissions on buying stocks, ETFs, REITs, and ADRs. However, they charge you for e-wallet deposits made via Gotrade for 3% and 5% for credit card deposits. Every country will have different fees. So, we recommend you check the deposit method available in your country.

There is a withdrawal fee of $2. This fee is available for supported local currencies/countries only. However, this isn’t Gotrade’s fee. It’s a fee that Gotrade is charged to send your funds back to you. We know that Gotrade is working to bring these down for everyone. They aim to get this down to $0 in the long run.

Gotrade Pros and Cons

There are several pros and cons before you decide to invest your money in US stocks via Gotrade.

Pros

- Easy to use and beginner friendly.

- You can buy US stocks starting from $1.

- Instant withdrawal after 3 days of waiting time.

Cons

- You might need to invest at least $30 if you decide to invest in public company stock. Otherwise, you might lose your initial investment due to the fluctuating rate.

- You still have to learn about the fundamentals of stock trading to know when to buy and sell your stocks.

Frequently Asked Questions

Is Gotrade Regulated?

Yes, they are. Gotrade is a trading name of Gotrade Securities Inc., licensed by the Labuan Financial Services Authority.

Does Gotrade offer Contracts For Difference (CFDs)?

No. Gotrade does not offer CFDs. You will be trading actual shares directly on the NYSE and NASDAQ. Your name is on the list as the genuine and beneficial owner of the stock you buy. You have the rights associated with security factors, such as dividends and voting rights.

Is it possible to invest in US shares from outside the US?

Yes. Gotrade enables clients from over 150 countries to invest in US shares.

What are the different order types?

Gotrade supports 3 different order types right now. Market orders in dollars, market orders in shares, and limit orders.

Market Orders in Dollars

This type of order allows you to input your order in a dollar amount, starting from $1.

Market Orders in Shares

This order type allows you to input your order in numbers of shares, starting at 0.000000001. But, subject to $1.

Limit Order

This order type allows you to input your order in share amounts starting at 1. This means fractional shares are not supported.

The goal with a limit order is to define the price you’re willing to trade at (the “limit price”). So, your execution will be at the “limit price” or better than the “limit price.”

For example, if you set an order to buy 1 share of Apple at a limit price of $100. The order will only execute at $100 or lower.

What’s the difference between market orders in dollars and market orders in shares?

Let’s answer this using an example.

Let’s say it’s 6 PM Eastern Time, the market is closed, and Amazon ended the previous day at $100/share.

John enters a market order in dollars for $100. Mary enters a market order in shares for 1 share.

So, when the stock price opens at $110/share on the next day, both trades from John and Mary are executed.

John gets 0.909091 shares for his $100.

Mary gets 1 share for her $110.

That’s the difference between the two order types.

Conclusion

To summarize our Gotrade review, it is one of the best stock investment apps for beginners. As we mentioned earlier, we had no idea about investment until we found Gotrade. Moreover, we didn’t know we could start investing with just $1.

We strongly recommend this app to everyone who wants to start investing in stocks. It has a beginner-friendly user interface, and the verification process does not take long. More importantly, your funds are in the safe hand.

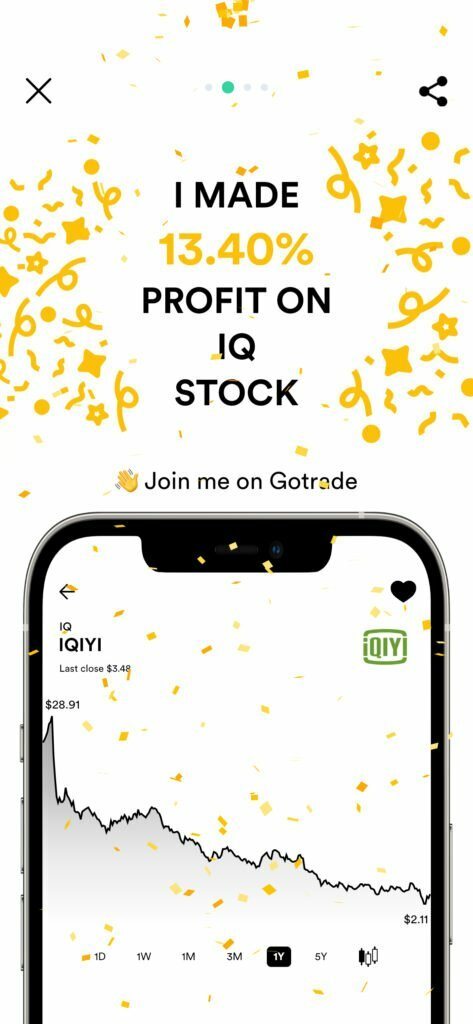

Here are examples of our small achievements on Gotrade.