SoFi Personal Loans: Key Details and How to Apply

Anúncios

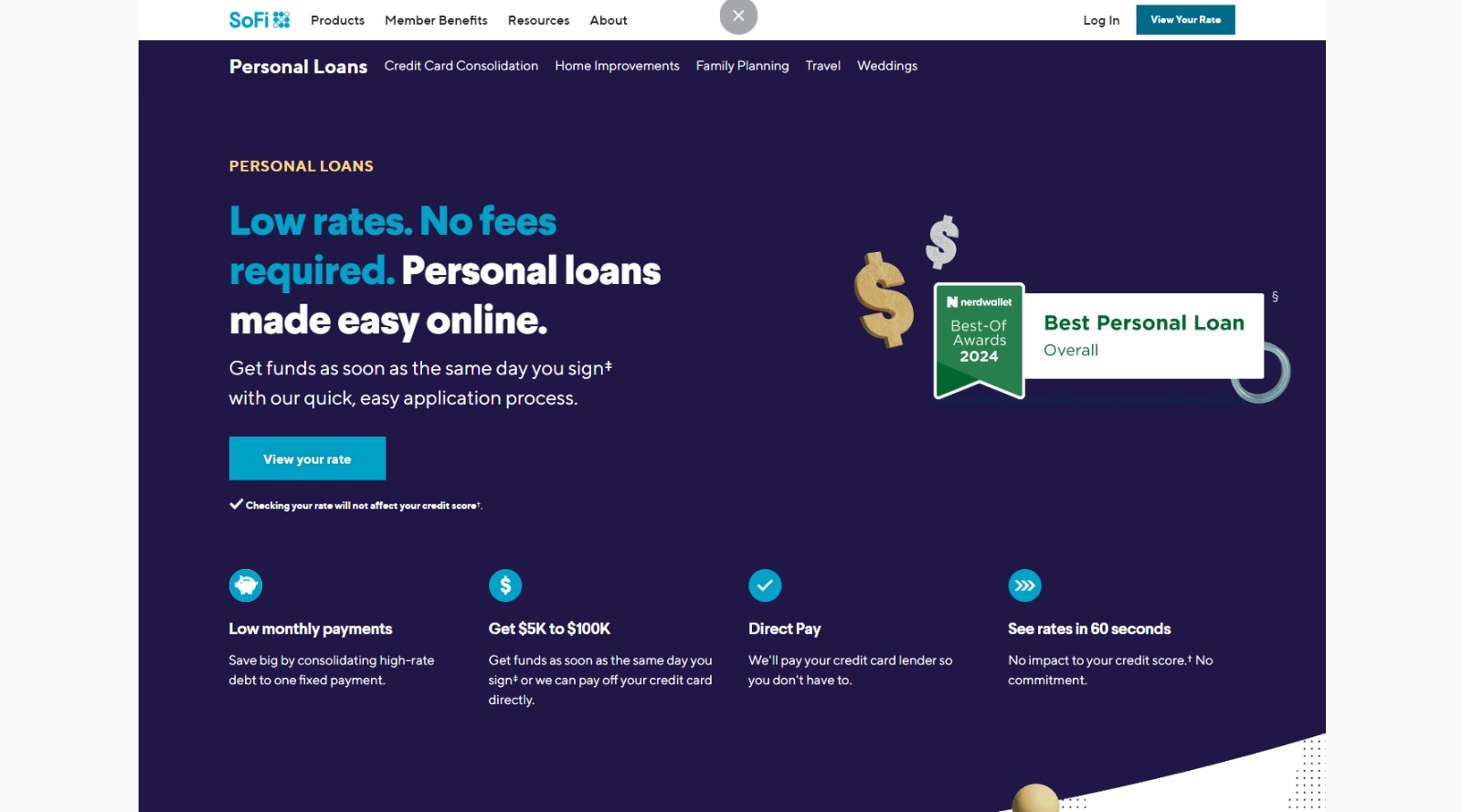

SoFi Personal Loans offer a flexible, fee-free, and convenient financial solution for borrowers looking to cover various expenses.

With competitive interest rates, no collateral requirements, and a seamless online application process, SoFi has become a leading personal loan provider in the market.

Anúncios

In this article, we’ll dive into the eligibility criteria, loan terms, benefits, drawbacks, and step-by-step application process to help you determine if this loan is the right choice for you.

Who Is Eligible for a SoFi Personal Loan?

To qualify for a SoFi Personal Loan, applicants must meet specific eligibility requirements:

Anúncios

- Residency and Age: Must be 18 years or older (or the legal age in their state), a U.S. citizen, permanent resident, or visa holder living in an eligible state.

- Creditworthiness: A good to excellent credit score is recommended to qualify for the most competitive rates.

- Income Verification: Borrowers must provide proof of income, such as pay stubs or tax returns, along with a record of monthly expenses and employment history.

These requirements ensure that borrowers can responsibly manage repayment obligations while securing favorable loan terms.

Key Features of SoFi Personal Loans

Before applying, it’s important to understand the main terms and conditions of SoFi Personal Loans:

- APR (Annual Percentage Rate): Fixed interest rates from 8.99% to 29.49% with autopay, depending on credit score, loan amount, and repayment term.

- Loan Term: Borrowers can select repayment terms between 2 and 7 years, allowing flexibility to fit different budgets.

- Loan Amount: Loan amounts range from $5,000 to $100,000, making SoFi a suitable option for both small and large financial needs.

These flexible terms and competitive rates make SoFi an appealing choice for borrowers with diverse financial goals.

Advantages of SoFi Personal Loans

SoFi offers several standout features that set it apart in the personal loan market.

Fast Fund Disbursement

Once approved, funds are disbursed quickly, often within a few business days.

This makes SoFi an ideal choice for time-sensitive financial needs, such as:

- Debt consolidation;

- Emergency expenses;

- Major purchases.

By eliminating long wait times, SoFi ensures you receive the money when you need it most.

No Fees

SoFi’s zero-fee structure provides borrowers with peace of mind, as they won’t face:

- Origination Fees: No upfront processing costs—borrowers receive the full approved loan amount.

- Prepayment Penalties: You can pay off your loan early without extra charges, helping you save on interest.

This commitment to transparency and cost savings makes SoFi an attractive choice.

No Collateral Required

SoFi Personal Loans are unsecured, meaning no assets (home, car, etc.) are required as collateral.

This simplifies the approval process and reduces financial risk for borrowers.

Potential Drawbacks of SoFi Personal Loans

While SoFi Personal Loans offer numerous benefits, there are some limitations to consider.

Fixed Monthly Payments

If you make extra payments, your monthly payment will not decrease automatically—instead, the extra funds go toward paying off the loan faster.

Reapplication Waiting Period

If your application is denied, you must wait at least 30 days before reapplying, which can be inconvenient for those with immediate financial needs.

Understanding these potential drawbacks helps borrowers make informed decisions before applying.

How to Apply for a SoFi Personal Loan

The application process for a SoFi Personal Loan is quick and fully online.

Here’s how to get started:

- Online Application: Visit the SoFi Personal Loans page to begin your application. Use the pre-qualification tool to check potential loan rates without affecting your credit score.

- Review Process: SoFi evaluates your creditworthiness, income, and financial profile to determine eligibility.

- Approval and Funding: Once approved, funds are disbursed quickly, ensuring you can use them for your intended purpose without delay.

SoFi Personal Loans offer a fast, transparent, and flexible borrowing experience.

With competitive rates, no fees, and a hassle-free application process, SoFi is a strong option for borrowers looking for a cost-effective personal loan.

However, it’s important to consider factors like fixed monthly payments and reapplication waiting periods before applying.

Contact: For questions, you can reach SoFi support at 1-855-456-7634.

Want to explore more details and start your application? Visit SoFi’s official website today!

This content was created in January 2025. Loan terms and details may change, so please consult SoFi’s official website for the most accurate and updated information.