Learn About the US Bank Personal Loan and How to Apply

Anúncios

Personal loans serve as a versatile financial tool for covering various expenses, and the US Bank Personal Loan stands out for its accessibility and benefits.

No matter what your financial needs are, this loan provides a straightforward and dependable borrowing option.

Anúncios

In this guide, we’ll explore the key details of the US Bank Personal Loan, including its advantages, potential downsides, and the application process.

What Are the Requirements to Apply for the Loan?

To be eligible for a US Bank Personal Loan, applicants must meet the following conditions:

Anúncios

- Be an existing US Bank customer with an active checking or savings account (Non-customers may face stricter qualifications).

- Maintain a strong credit score and a solid financial history.

- Be at least 18 years old (or the legal age of majority in their state).

- Provide income verification documents and a valid form of identification.

Meeting these criteria helps ensure a smooth application process and increases the likelihood of loan approval.

Key Information About the Loan

Like other lenders, US Bank provides clear details about its personal loan offerings:

- APR (Annual Percentage Rate): Fixed rates range from 8.74% to 24.99%, ensuring consistent monthly payments with no fluctuations in interest rates.

- Loan Term: Borrowers can select repayment periods ranging from 12 to 84 months, depending on their financial needs and preferences.

- Loan Amount: Available loan amounts range from $1,000 to $50,000, offering flexibility for both minor and major expenses.

Benefits of the US Bank Personal Loan

One of the standout features of the US Bank Personal Loan is the range of benefits it offers, making it a preferred choice for borrowers seeking flexibility and convenience.

Ease of Application

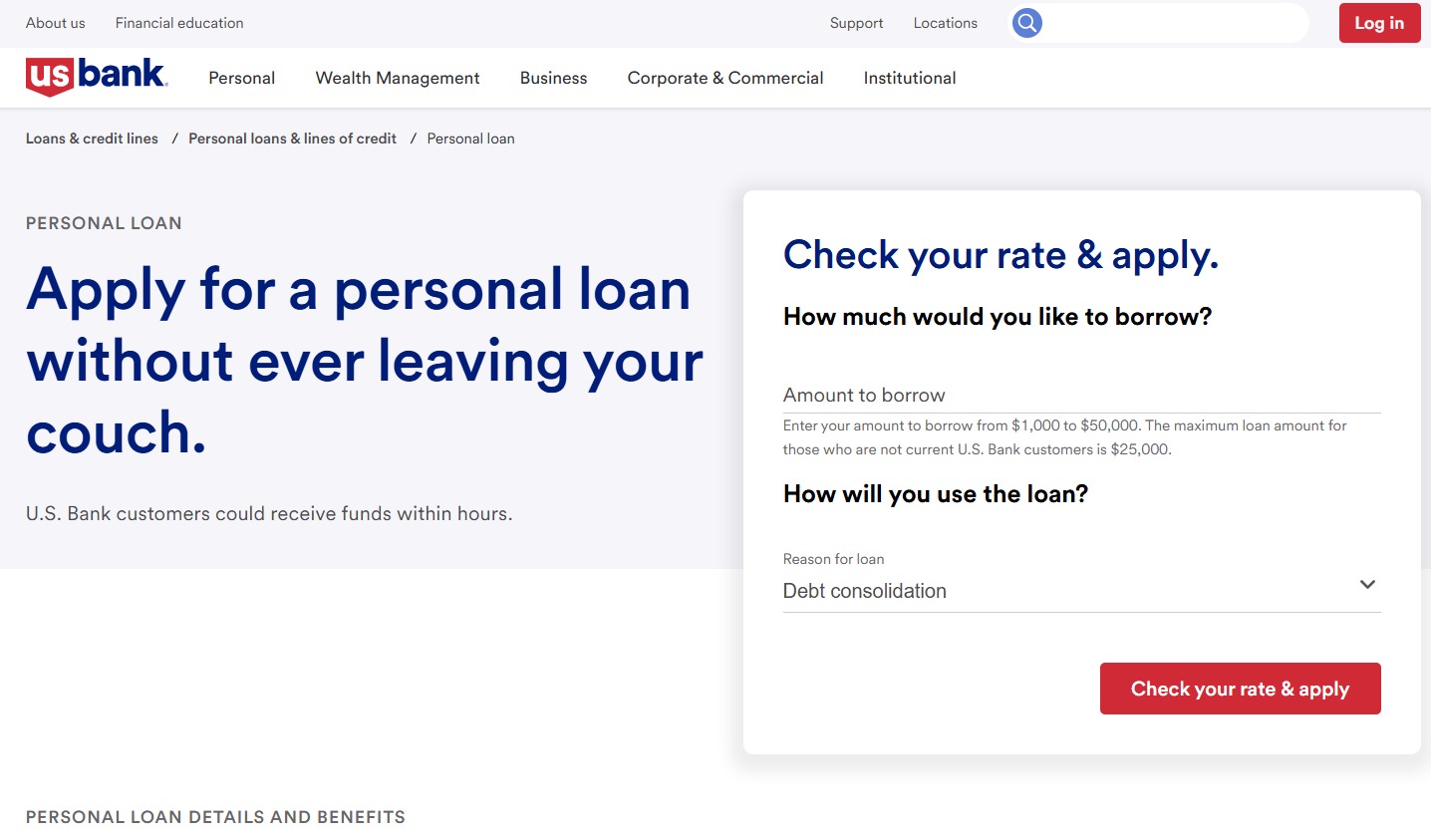

A major advantage of US Bank Personal Loans is the simple and flexible application process.

Applicants can choose from multiple ways to apply, including online applications, phone assistance, or in-person visits at a US Bank branch.

This flexibility allows borrowers to select the method that best fits their needs, whether they prefer a fully digital experience or personalized support.

Custom Payment Estimates

Another valuable benefit is the ability to customize payment estimates, helping borrowers make informed decisions.

US Bank offers an online loan calculator where applicants can enter their desired loan amount and repayment term to get an estimated monthly payment.

This tool is useful for budgeting and ensuring that the loan aligns with the borrower’s financial situation and long-term goals.

By having a clear understanding of payment obligations upfront, applicants can confidently select a repayment plan that fits their needs.

No Origination or Prepayment Fees

Another notable advantage is that US Bank does not charge origination or prepayment fees.

Many lenders charge origination fees to process a loan, which increases the overall borrowing cost. US Bank eliminates this expense, making the loan more affordable.

Similarly, borrowers can pay off their loan early without penalty, providing flexibility for those who want to reduce their debt faster without extra charges.

Drawbacks of the US Bank Personal Loan

While the US Bank Personal Loan offers numerous benefits, there are a few limitations that prospective borrowers should consider before applying.

These drawbacks, although not deal-breakers for most, can influence the overall experience for certain applicants.

Funding for Non-US Bank Accounts

One limitation of US Bank Personal Loans is the funding timeline for borrowers without a US Bank account.

If a borrower chooses to have their loan funds deposited into an external bank account, the transfer may take longer than expected.

Once the loan is approved and verified, it may take 1 to 4 business days for the funds to be processed.

This delay could be inconvenient for those needing immediate access to cash. However, existing US Bank customers often experience faster transfers.

Availability Restrictions

Another important consideration is that US Bank Personal Loans are not available in all states.

This limitation may affect potential applicants, as certain loan programs may not be accessible depending on location.

To avoid issues, it’s essential for borrowers to check the loan’s availability in their state before proceeding with an application.

This can be done by contacting US Bank directly or reviewing their website for updated location details.

Step-by-Step Guide to Applying

Applying for a US Bank Personal Loan is a straightforward process:

- Visit the US Bank Website: Go to the Personal Loan section and select “Apply Now.”

- Fill Out the Application: Enter personal information, income details, and the desired loan amount.

- Use the Loan Calculator: Estimate a custom payment plan to ensure affordability.

- Submit Your Application: Apply online or by phone. If approved, review the loan terms and accept the offer.

- Receive Funds: Funds are typically disbursed quickly for existing US Bank customers and within 1 to 4 business days for non-customers.

For assistance during the application process, applicants can call US Bank at 888-495-2659 for personalized support.

The US Bank Personal Loan is a practical and flexible financing option designed to meet various personal financial needs.

For more detailed service information and to start an application, visit the official website.

This content was produced in January 2025, specific service information may change, so please check the lender’s official website.