Understand What Wells Fargo Personal Loans Offer and How to Apply

Anúncios

The Wells Fargo Personal Loan is a flexible and accessible financial solution designed to help borrowers manage various expenses.

Backed by one of the most trusted banks in the U.S., this loan provides competitive interest rates, transparent terms, and a straightforward application process.

Anúncios

In this article, we will explore everything you need to know about Wells Fargo Personal Loans, including their features, eligibility requirements, benefits, potential drawbacks, and a step-by-step guide to applying.

Key Details About the Loan

Before applying, it’s important to understand the key terms of a Wells Fargo Personal Loan.

Anúncios

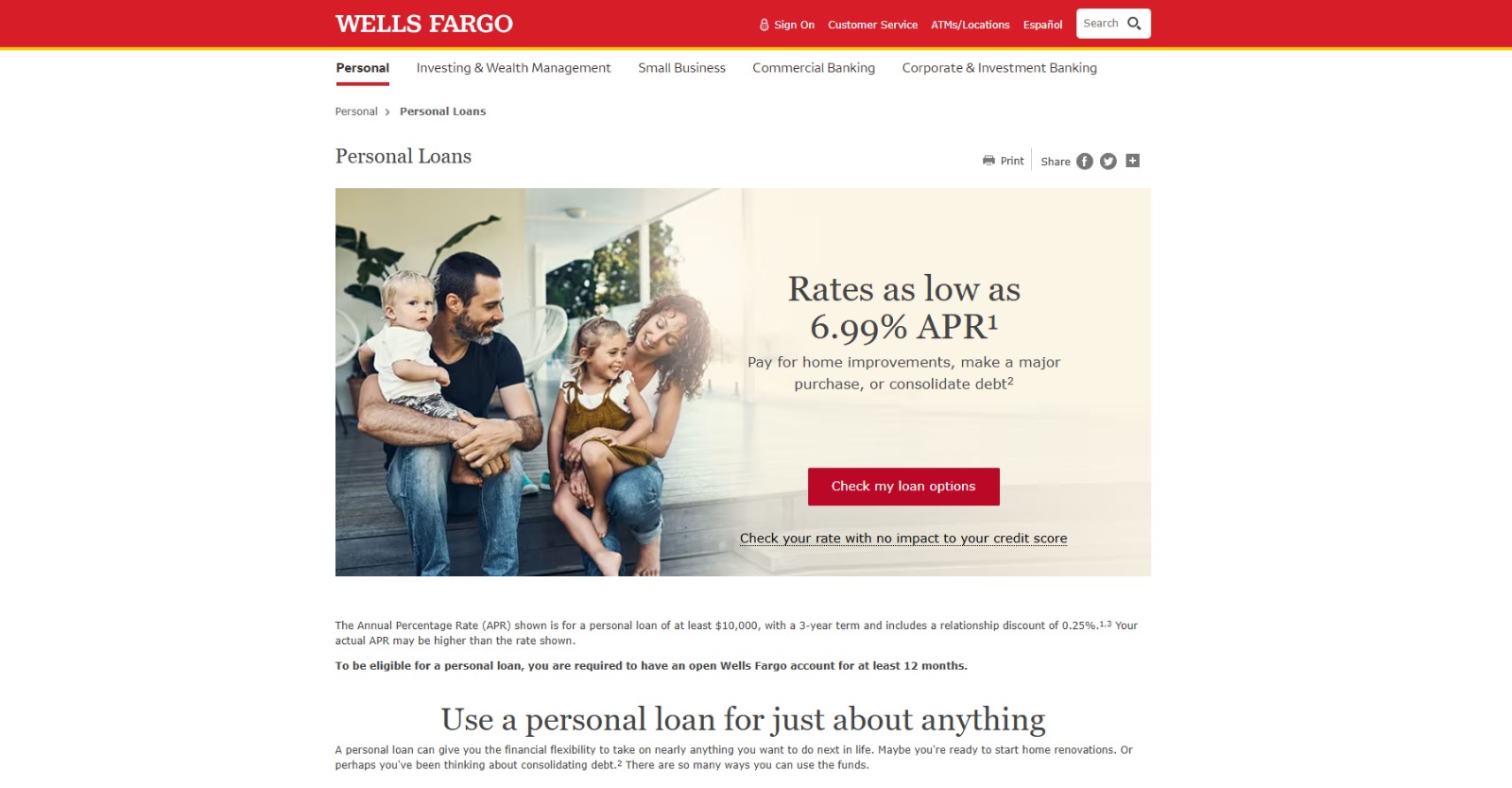

- APR (Annual Percentage Rate): Fixed interest rates that provide consistent monthly payments. Depending on your credit score and financial qualifications, rates can range from 6.99% to 24.49%.

- Loan Term: Repayment periods range from 12 to 84 months, offering flexibility to fit different budgets.

- Loan Amount: Borrowers can access loan amounts from $3,000 to $100,000, making it suitable for both small expenses and larger financial needs.

These loan terms ensure predictability and manageable payments, making financial planning easier for borrowers.

Eligibility Requirements

To qualify for a Wells Fargo Personal Loan, applicants must meet specific criteria:

- Have an active Wells Fargo account for at least 12 months.

- Maintain strong creditworthiness, as approval depends on credit history and income.

- Provide standard documentation, including proof of income, government-issued ID, and other financial details.

- Be a U.S. citizen or permanent resident and meet the minimum age requirement in their state.

Wells Fargo provides an application checklist to help borrowers confirm their eligibility before applying.

Meeting these requirements ensures that loans are issued to individuals who can responsibly manage repayment, leading to a positive borrowing experience.

Why Choose a Wells Fargo Personal Loan?

The Wells Fargo Personal Loan stands out due to its competitive rates, transparency, and convenience. Below are some of the key benefits:

Competitive Interest Rates

Wells Fargo is known for offering competitive fixed interest rates, making their loans an attractive option for borrowers.

Fixed rates ensure stable monthly payments, eliminating concerns about fluctuating interest rates over time.

Additionally, borrowers with qualified Wells Fargo accounts may receive a discount on interest rates by enrolling in automatic payments.

No Hidden Fees

A major advantage of Wells Fargo Personal Loans is their lack of origination fees, prepayment penalties, or hidden charges.

This means borrowers only pay the agreed loan amount, making the process straightforward and cost-effective.

Additionally, early repayment is allowed with no penalties, helping borrowers save on interest if they choose to pay off their loan ahead of schedule.

Simple and Accessible Application Process

Wells Fargo has designed its loan application process to be quick and convenient.

Applicants can apply online or over the phone, depending on their preference.

- Online Application: Borrowers can complete their loan application from the comfort of home, making the process easy and efficient.

- Phone Application: Trained representatives are available to guide applicants through each step, answering any questions they may have.

Potential Drawbacks of Wells Fargo Personal Loans

While Wells Fargo Personal Loans offer numerous benefits, there are a few limitations to consider:

Requirement for a Wells Fargo Account

Only existing Wells Fargo customers who have held an account for at least 12 months are eligible to apply.

This restriction may limit access for individuals who are new to the bank or considering switching financial institutions.

Restricted Loan Use

While personal loans are generally flexible, Wells Fargo does not allow these funds to be used for:

- Real estate purchases or investments

- Business financing

Borrowers looking to fund these expenses will need to consider alternative lending options.

Credit Score Impact on Approval

Approval for a Wells Fargo Personal Loan depends heavily on credit history and income.

Applicants with poor or limited credit history may face challenges in getting approved or may receive higher interest rates.

Step-by-Step Guide to Applying

Applying for a Wells Fargo Personal Loan is a simple process with multiple options:

- Online Application: Visit Wells Fargo’s official website, complete the application form, and check your eligibility using their prequalification tool, which does not affect your credit score.

- Phone Application: Call 1-877-526-6332 to speak with a representative who will assist you through the process.

Each method is designed for convenience, allowing applicants to choose the option that works best for them.

The Wells Fargo Personal Loan is a reliable and flexible financing option for individuals looking to consolidate debt, make large purchases, or cover unexpected expenses.

However, borrowers should carefully consider the requirement for an existing Wells Fargo account and usage restrictions before applying.

You can reach Wells Fargo support at 1-877-526-6332.

Click the button below to visit Wells Fargo’s official website, explore more details, and begin your application today.

This content was produced in January 2025. Specific service information may change, so check the official Wells Fargo website.